With shares of Sony (NYSE:SNE) trading around $22, is SNE an OUTPERFORM, WAIT AND SEE, or STAY AWAY? Let�� analyze the stock with the relevant sections of our CHEAT SHEET investing framework:

T = Trends for a Stock’s Movement

Sony is involved in�the electronics, games, entertainment, and financial businesses. The company operates in several different segments: Consumer Products Services, Professional Device Solutions, Movie, Music, Finance, Mobile, and Other. Through its segments, Sony is able to provide a wide range of products and services.

These products include televisions, cameras, personal computers, game consoles, navigation systems, audio and video equipment, software, phones, and media platforms. The company�bring�new technologies to the hands of your average Joe, as well as professional users. Look for Sony to continue to be a top choice for avid technology adopters worldwide.

Sony electronics division made a profit in the second quarter for the first time in two years, but the company is still forecasting difficulties for its electronics ventures in the future. The uncertainty surrounding Sony�� ability to compete in the electronics market has increased pressure on the board to consider activist investor Daniel Loeb�� suggestion that the company split in two, creating separate businesses for electronics and Sony�� much more profitable entertainment arm.

Hot Tech Stocks To Invest In Right Now: Chyron Corporation(CHYR)

Chyron Corporation supplies graphics hardware, software, and workflow solutions for multimedia outlets; government agencies; telecommunications and corporate customers; and educational, health, and religious institutions. It offers AXIS Graphics online content creation software, HD/SD switchable on-air graphics systems, clip servers, channel branding and telestration systems, graphic asset management and XMP integration solutions, and the WAPSTR mobile phone newsgathering application. The company?s graphics products provide broadcast-quality, real-time, HD/SD, 2D/3D, graphics creation and playout for television stations, networks, video production, and post-production markets. Its hardware products include Graphics System/CG Family for television graphics applications; Channel Box systems for branding applications; XClyps/XClyps SAN/MicroClyps for control over graphics playout; CodiStrator HD/SD Telestration Systems that enable commentators to illustrate in real time over live video; and platforms and board sets for third-party developers. The company also provides AXIS Graphics suite of Web-based services and applications; and AXIS order management systems. In addition, it offers Software Products, such as Lyric, an advanced graphics creation and playback application; the Lyric Enhancement Interface Framework, an application programming interface for developing custom programs; and Chyron Application Library, an API that can be used to real time broadcast graphics applications. Further, it provides newsroom integration and asset management products comprising Chyron Asset Management InterOperability; iRB, an intelligent rundown builder; iSQ, an intelligent sequencer; and mobile suite, as well as graphic design, technical, and support and training services. Chyron Corporation was formerly known as The Computer Exchange, Inc. and changed its name to Chyron Corporation in November 1975. The company was founded in 1966 and is headquartered in M elville, New York.

Hot Tech Stocks To Invest In Right Now: Alvarion Ltd.(ALVR)

Alvarion Ltd. supplies top-tier carriers, Internet service providers (ISPs), and private network operators with solutions based on the worldwide interoperability for Microwave Access (WiMAX) standard, as well as other wireless broadband solutions. The company provides WiMAX and non-WiMAX wireless broadband systems, and launched 250 commercial WiMAX deployments worldwide. Its solutions are designed to cover a range of frequency bands with fixed, portable, and mobile applications to enable the delivery of personal broadband services, business and residential broadband access, corporate virtual private network (VPN), toll quality telephony, mobile base station feeding, hotspot coverage extension, and services for various vertical markets, such as municipalities, public safety, mining, utilities, video surveillance, and border control. The company?s business mainly focuses on solutions, based on the WiMAX standard, that are used for primary wireless broadband access. In addit ion, Alvarion sells its non-WiMAX products, which address point-to-point and point-to-multipoint architectures for various end-user profiles, including residential, small office/home office, small/medium enterprises, multi-tenant/multi-dwelling units, and large enterprises, as well as provides network management solutions for its wireless solutions. Its solutions provide high-speed wireless ?last mile? connection to the Internet for homes and businesses in both developed and emerging markets. The company was formerly known as BreezeCOM Ltd. and changed its name to Alvarion Ltd. as result of merger with Floware Wireless Systems Ltd. in August 2001. Alvarion Ltd. was founded in 1992 and is headquartered in Tel Aviv, Israel.

Advisors' Opinion: - [By Eric Volkman]

Alvarion (NASDAQ: ALVR ) is now on the hunt for a new chief executive. Hezi Lapid has resigned as CEO, although he will stay in the position until "such time that a smooth transition is completed," the company said in a press release announcing the move.

Dot Hill Systems Corp. designs, manufactures, and markets a range of software and hardware storage systems for the entry and midrange storage markets worldwide. Its storage solutions consist of integrated hardware, firmware, and software products employing a modular system that allows end-users to add various protocol, performance, capacity, or data protection schemes. The company offers AssuredSAN products, a flexible line of networked data storage solutions for open systems environments, including fiber channel, Internet small computer systems interface, and serial attached small computer systems interface, or SAS storage markets. Its AssuredSAN product lines range from approximately 146 gigabyte to 192 terabyte storage systems. The company also provides RAID software for industry standard Windows and Linux servers, as well as storage management applications, which manage its storage system configurations. In addition, it sells DMS software products comprising AssuredSna p, AssuredCopy, AssuredRemote, and RAIDar. Further, the company offers standalone storage software products, such as AssuredUVS, a unified virtual storage appliance product; and AssuredVRA. It sells its products through original equipment manufacturers, systems integrators, distributors, and value added resellers. The company was founded in 1988 and is headquartered in Longmont, Colorado.

Advisors' Opinion: - [By John Udovich]

Small cap storage stock Dot Hill Systems Corp (NASDAQ: HILL) is up 193.4% since the start of the year for a much better performance than its larger cap peers Western Digital Corp (NASDAQ: WDC) and SanDisk Corporation (NASDAQ: SNDK), which are 55.5% and 35.3%, respectively, since the start of the year. So why has this relatively unknown small cap storage stock been a better performer than its better known storage stock peers?

- [By John Udovich]

On Monday, small cap storage stock Violin Memory Inc (NYSE: VMEM) surged 21.56% after booting out its CEO in the wake of disappointing earnings and IPO, meaning its time to take a closer look at the stock along with the performance of potential or better known storage peers like large caps SanDisk Corporation (NASDAQ: SNDK) and Western Digital Corp (NASDAQ: WDC) plus small cap Dot Hill Systems Corp (NASDAQ: HILL).

Hot Tech Stocks To Invest In Right Now: AVG Technologies NV (AVG)

AVG Technologies N.V. (AVG), incorporated on March 3, 2011, provides software and online services. The Company is primarily engaged in the development and sale of Internet security software and online service solutions branded under the AVG name. The Company�� solutions include software and online services, include security, personal computer (PC) management, online backup and other products. As of December 31, 2011, the Company had approximately 15 million subscription users. AVG�� portfolio consists of Anti-Virus suite, Internet Security suite, Premium Security suite, AVG Mobilation, AVG Threatlabs, Family Safety, TuneUp Utilities and PC Tuneup, LiveKive and MultiMi. On January 4, 2011, the Company acquired DroidSecurity Ltd. On March 3, 2011, the Company established AVG Holding Cooperatief U.A. On May 18, 2011, the Company acquired iMedix Web Technologies Ltd. In August 2011, it acquired TuneUp Software GmbH. On August 19, 2011, AVG Technologies GER GmbH acquired TuneUp Software GmbH. On October 31, 2011, AVG Technologies Holdings B.V. acquired AVG Distribution Switzerland AG. In November 2011, the Company acquired Bsecure Solutions, Inc. On January 13, 2012, AVG Technologies USA, Inc. acquired OpenInstall, Inc. In May 2013, AVG Technologies NV acquired online privacy organisation PrivacyChoice.

The Company�� products include AVG Internet Security, AVG Anti-Virus, AVG Email Server Edition, AVG File Server Edition, AVG Linux Server Edition, AVG Rescue CD and AVG Remote Administration. The Company�� subsidiaries include AVG Technologies USA Inc., AVG Technologies CZ, s.r.o., AVG Technologies UK Ltd, AVG Exploit Prevention Labs, Inc., AVG Technologies GER, GmbH, AVG Technologies FRA SAS, AVG Technologies HK, Limited, AVG (Beijing) Internet Security Technologies Company Limited, AVG Mobile Technologies Ltd, AVG Netherlands B.V., AVG Ecommerce CY Ltd, AVG Technologies Holding B.V., TuneUp Software GmbH, TuneUp Distribution GmbH, TuneUp Corporation and AVG Distribution Switzerland AG! .

The Company competes with Microsoft, Google, Apple, Qihoo, Tencent, Facebook, UniBlue, Symantec, Trend Micro, Avast!, Avira, Symantec, Carbonite, Dropbox, Intel Corporation, Trend Micro, Eset, Kaspersky Labs, Panda Software, Sophos, Rising, Kingsoft, Check Point and F-Secure.

Advisors' Opinion: - [By MONEYMORNING.COM]

For instance, in the March 15 Private Briefing report, "Double Your Money With this Cyber-Hacking of America Stock," we recommended AVG Technologies NV (NYSE: AVG), an Amsterdam-based cybersecurity whose shares we believed were good for a 100% gain in a year.

- [By Seth Jayson]

AVG Technologies (NYSE: AVG ) reported earnings on April 24. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended March 31 (Q1), AVG Technologies beat expectations on revenues and crushed expectations on earnings per share.

- [By Igor Novgorodtsev]

InterActiveCorp (IACI) bought Ask.com for $1.85 billion in 2005. The new Perion will be worth only about 40% of that. After the merger, Perion will leapfrog its much larger rivals: Babylon and AVG (AVG). Finally, Perion should be able to increase its operating margins as it can spread its SG&A costs over a much larger base (Conduit EBITDA margin is 32% vs. Perion's 23%). Perion will keep its senior management team intact: Josef Mandelbaum will remain its CEO and Yacov Kaufman its CFO. Perion has successfully orchestrated a roll-up acquisitions of privately-held Sweetpacks and Smilebox, so I have high confidence that they know how to integrate a new business.

Hot Tech Stocks To Invest In Right Now: NVIDIA Corporation(NVDA)

NVIDIA Corporation provides visual computing, high performance computing, and mobile computing solutions that generate interactive graphics on various devices ranging from tablets and smart phones to notebooks and workstations. It operates in three segments: Graphic Processing Unit (GPU), Professional Solutions Business (PSB), and Consumer Products Business (CPB). The GPU segment offers GeForce discrete and chipset products, which support desktop and notebook personal computers plus memory products. The PSB segment provides its Quadro professional workstation products and other professional graphics products, including its NVIDIA Tesla high-performance computing products used in the manufacturing, entertainment, medical, science, and aerospace industries. The CPB segment offers Tegra mobile products, which support tablets, smartphones, personal media players, Internet television, automotive navigation, and other similar devices. This segment also licenses video game consol es and other digital consumer electronics devices. The company sells its products to original equipment manufacturers, original design manufacturers, add-in-card manufacturers, consumer electronics companies, and system builders worldwide that utilize its processors as a core component of their entertainment, business, and professional solutions. NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California.

Advisors' Opinion: - [By John Udovich]

Its been about two weeks since the latest earnings report from Advanced Micro Devices, Inc (NYSE: AMD) which sent the stock lower yet again. I should mention that we have�had AMD in our SmallCap Network Elite Opportunity (SCN EO) portfolio since mid-July and its been a rollercoaster ride for the past few months because the summer earnings report (which appeared on the same day as some other disappointing earnings reports) erased our gains, which we then made back���only to have�those gains�erased again with the latest earnings report (See my previous article: Time to be Bullish, Bearish or Just Realistic? Advanced Micro Devices��(AMD) Third Quarter Earnings Report). Nevertheless, we still think the company represents a�good value opportunity as it continues to transition away from dependence on the PC and into mobility and gaming consoles. With that in mind, here is the latest important news about AMD for investors and traders to hit the newswires since earnings:

The New AMD Radeon R9 290X Graphics Card is Launched. Last Thursday, Advanced Micro Devices announced the launch of the�AMD Radeon��R9 290X graphics card and already there are some good reviews with Vlad Savov writing one for TheVerge.com�under the headline:���MD's latest graphics card is a steal at $549�� Should You Buy An AMD R9 290X Or Nvidia GTX 780? On Monday, Forbes contributor Jason Evangelho wrote a lengthy piece comparing NVIDIA Corporation�� (NASDAQ: NVDA) GTX 780 with AMD�� R9 290x where he noted that 24 hours ago, his�results would have led to a dramatically different conclusion: Buy AMD�� 290x since it�� $100 cheaper and offers comparable, if not superior, performance to its closest competitor. With this morning�� aggressive price cut, however, Nvidia may be causing droves of tech journalists to revisit their 290x reviews. As things stand now, Nvidia�� GTX 780 is $499, while AMD�� R9 290x is $549. Make no mistake: both cards are a steal at these pricep

- [By Adam Levine-Weinberg]

AMD is also entering a significant product launch cycle, and management believes it can retake share from Intel, particularly for entry-level PCs. The management team is also bullish about its ability to regain share in GPUs from NVIDIA (NASDAQ: NVDA ) following new product launches later this year. However, the big long-term goal seems to be gaining embedded and semi-custom design wins, and AMD has made progress here by winning the slots for Nintendo's new Wii U, the PlayStation 4, and (reportedly) the new Xbox.

Hot Tech Stocks To Invest In Right Now: Sage Grp(SGE.L)

The Sage Group plc, together with its subsidiaries, engages in the development, distribution, and support of business management software and related products and services for small and medium-sized enterprises worldwide. The company provides products and services in the areas of accounting, payroll, customer relationship management, financial forecasting, payment processing, job costing, human resources, business intelligence, taxation and other products for accountants, business stationery, development platforms, e-business, and enterprise resource planning, as well as offers solutions for various industries. The Sage Group plc was founded in 1981 and is based in Newcastle Upon Tyne, the United Kingdom.

Hot Tech Stocks To Invest In Right Now: American Software Inc (AMSWA.O)

American Software, Inc. (American Software), incorporated in 1970, develops, markets and supports a portfolio of software and services that delivers enterprise management and collaborative supply chain solutions to the global marketplace. American Software operates three business segments: Supply Chain Management (SCM), Enterprise Resource Planning (ERP) and Information Technology (IT) Consulting. The SCM segment consists of Logility, Inc. (Logility), which provides collaborative supply chain solutions for forecasting, production, distribution and management of products between trading partners. The ERP segment consists of American Software ERP, which provides purchasing and materials management, customer order processing, financial, e-commerce, flow manufacturing and manufacturing solutions, and New Generation Computing (NGC), which provides business software to both retailers and manufacturers in the apparel, sewn products and furniture industries. The IT Consulting s egment consists of The Proven Method, Inc., an IT staffing and consulting services firm. The Company also provides support for its software products, such as software enhancements, documentation, updates, customer education, consulting, systems integration services, and maintenance.

Supply Chain Management

The Company�� wholly owned subsidiary Logility provides SCM solutions, an integrated set of supply chain planning, inventory optimization, manufacturing, and transportation and logistics solutions. Logility provides SCM solutions to streamline and optimize the market planning, management, production, and distribution of products for manufacturers, suppliers, distributors, and retailers. As of April 30, 2011, Logility�� customer base is approximately 1,250 companies located in more than 74 countries. Logility markets and sells the Demand Solutions product line to the global small and midsize enterprise (SME) market through the global VAR distri bution network of Demand Management, Inc. (DMI). Logility ! al! so offers the Logility Voyager Solutions suite.

Logility Voyager Solutions is an integrated software suite that provides SCM, including collaborative planning, strategic network design, multi-echelon inventory optimization, optimized supply sourcing, production management, warehouse management, and collaborative logistics capabilities. Logility Voyager Solutions incorporates performance management analytics for decision support for processes, such as demand management, inventory and supply optimization, manufacturing planning and scheduling, transportation planning and management and sales and operations planning (S&OP).

The Logility Voyager Solutions software suite is modular and scalable to meet the management requirements of global organizations involving products with manufacturing or distribution networks. In addition, the Logility Voyager Solutions suite interfaces with a range of existing enterprise applications deployed on a range of technic al platforms. Logility Voyager Solutions accelerates S&OP, as well as strategic partner collaboration. Voyager Sales and Operations Planning enables companies to streamline and accelerate the entire S&OP process. Voyager Collaborate enables companies to communicate across their organizations and share supply chain information with external trading partners.

Voyager Fashion Forecasting helps improve profits with capabilities that address the collection launches for fashion-driven businesses. Voyager Demand Planning helps reconcile differences between business planning and detailed product forecasting. Voyager Life Cycle Planning provides control to model each phase in a product�� sunrise-to-sunset lifecycle, including introduction, maturity, replacement, substitution and retirement. Voyager Event Planning integrates marketing strategies with forecasting, distribution and logistics planning to calculate the impact of promotional plans and demand shaping strategi es, such as price discounts, coupons, advertising, spe! cial p! a! ckaging ! and product placement.

Logility Voyager Solutions enables enterprises to set inventory targets at each node of a multi-echelon distribution network to match strategic inventory goals and service levels. Voyager Inventory Optimization optimizes inventory investments across multi-echelon manufacturing and distribution networks to meet business and service level objectives for supply chains with multiple stages of inventory. Logility Voyager Inventory Planning allows enterprises to measure the tradeoff of inventory investment and desired customer service levels.

Logility Voyager Solutions optimizes material, inventory, production and distribution assets by synchronizing supply and demand. Voyager Supply Planning optimizes sourcing and production decisions to balance supply, manufacturing and distribution constraints based on corporate goals. Voyager Replenishment Planning provides visibility of future customer demand, corresponding product and materia l requirements, and the actions needed to satisfy those demands. Voyager Manufacturing Planning creates optimized constraint-based manufacturing schedules and compares multiple schedule scenarios to determine the optimal trade-off between manufacturing efficiencies, inventory investments and greenhouse gas emissions.

Logility Voyager Solutions provides capabilities for optimizing both warehouse and transportation operations. Voyager WarehousePRO provides shipping and inventory accuracy by optimizing the flow of materials and information through distribution centers. Voyager Transportation Planning and Management provide a multi-modal solution for savings of time, effort and money. It enables automated shipment planning, shipment execution and freight accounting. Demand Solution�� supply chain software provides a transition from spreadsheet management to robust reporting and tracking. Demand Solutions offers two separate product suites: traditional and DSX. The Demand Solutions application suite predict futur! e demand ! an! d make in! formed decisions to optimize inventory turns, customer service levels and profitability. Demand Solutions Forecast Management provides a demand planning solution that fits virtually any industry and deploys. Demand Solutions Requirements Planning incorporates collaborative planning capabilities to streamline supply activities from the production line through delivery.

Demand Solutions Collaboration offers a certified collaborative planning, forecasting and replenishment (CPFR) compliant collaborative planning solution that streamlines communications between a company and its customers and suppliers. Demand Solutions Sales & Operations Planning automates and continually analyzes the annual business planning process. Demand Solutions Advanced Planning and Scheduling is a production scheduling solution that supports both the process and discrete enterprise environment and produces accurate schedules taking into account machines, personnel, tooling and inventory co nstraints. Demand Solutions View (DS View) extends the value of Demand Solutions, empowering users to aggregate, rotate, filter, sort and otherwise manipulate large volumes of data into meaningful information. Demand Solutions Retail Planning enables manufacturers, distributors and retailers to collaboratively produce, ship and replenish product based on point-of-sale (POS) data.

Enterprise Resource Planning

The Company�� enterprise solutions are global solutions that link critical functions throughout an enterprise. The e-Intelliprise solution is a Web-based ERP system that a customer can run over the Internet, Intranet or Extranet utilizing the IBM iSeries servers. This allows functions within the ERP system to be deployed over the Internet using a Webpage capability. The e-Intelliprise solution is a global system, capable of operating in multiple languages and logistical organizations. Its e-applications are solutions for conducting business on the Internet that can Web-enable specific b! usiness f! unction! s through! integration with existing ERP or legacy systems. The e-applications are available for the applications, which include e-procurement, e-store, e-expenses, e-forms, e-payables, e-receivables, Purchase Order Tracking and Vendor Collaboration, Requisition Tracking, Shipment Tracking, e-process management and e-connect a seamless, XML-enabled data exchange.

The Company�� product line consists of software and services that operate on three strategic computer platforms, which includes IBM System z Mainframe or compatible, IBM System i (AS/400), and Intel-based servers and clients that operate Windows 2000, 2003, XP and Vista. It has written its products in various standard programming languages used for business application software, including ANSI COBOL, Micro Focus COBOL, C, C++, Visual Basic, JAVA, JAVA2 and other programming languages. Many have both on-line and batch capabilities.

IT Consulting

The Proven Method, Inc., the Company�� wholly owned subsidiary, is a technology services firm that specializes in assisting customer base to solve business issues with technology solutions. The solutions the Company provides ranges from Web applications to complex Business Intelligence applications and solutions. Business Intelligence consists of the development and implementation of a reporting process for dealing with data and multiple business entities/components. Its customers are Internet savvy and knowledgeable in wireless solutions, social networking and channeling implementations, server and desktop virtualization, and deployment of interactive applications. The Proven Method has customers, such as Aon, IBM, UPS, Norfolk Southern, Xerox, SunTrust Bank, Coca-Cola Enterprises, Kubota Manufacturing of North America, The Home Depot, AT&T, State of Georgia, CompuCom, Zep Inc, Chick-fil-A, Global Payments, Verizon, Catlin Group Ltd, Federal Home Loan Bank of Atlanta, Fulton Paper, Aaron Rents, AutoTrader.com, Nalco Chemical, Georgia Tech Research Ins! titute an! d numerous! other cu! stomers throughout the United States.

The Company competes with SAP, Oracle, Infor, JDA Software and Red Prairie.

Hot Tech Stocks To Invest In Right Now: Csr Ord 0.1p(CSR.L)

CSR plc, a fabless semiconductor company, designs and develops semiconductors and software based solutions in the United Kingdom, rest of Europe, the Americas, and Asia. It offers multifunction semiconductor platforms for the auto, camera, low energy connectivity, document imaging, and wireless voice and music markets; and semiconductors for the handset and other consumer electronics markets. The company?s technology portfolio comprises Bluetooth and Bluetooth SMART; global positioning system (GPS) and global navigation satellite systems location products; frequency modulated radio; Wi-Fi or wireless fidelity; audio and associated codec; near-field communication, a short range wireless technology that enables the transfer of data and secure transactions between devices; and imaging and video processing technologies. Its technologies have applications in a range of mobile consumer devices, such as handsets, tablets, automotive infotainments systems, personal navigation dev ices, wireless headsets, wireless audio systems, personal computers, GPS recreational devices, tracking and logistics management systems, digital cameras, printers, digital televisions, and gaming devices. The company markets its products to original equipment manufacturers and original design manufacturers primarily through its direct sales force and sales representatives, as well as through a network of distributors. It has operations in the United Kingdom, the United States, China, Taiwan, South Korea, Israel, Japan, and Singapore. CSR plc was founded in 1999 and is headquartered in Cambridge, the United Kingdom.

Delta CEO: ATL flights every 45 secs

Delta CEO: ATL flights every 45 secs  AP, Showtime From a high-end apparel retailer making a down-market move to the leading video service adding to its growing library, here are the wonders and blunders of the week. Amazon.com (AMZN) -- Winner Apple (AAPL) may have hit the market with the new iPad Air on Friday, but it was Amazon making the most of the launch -- to promote its own platform. Amazon has spent most of the week pushing its new 8.9-inch Kindle Fire HDX tablet at the top of the popular e-tailer's home page, pitting it against the iPad Air. Amazon points out that its Kindle Fire HDX is 20 percent lighter, packs 950,000 more pixels, and will set shoppers back $120 less than the somewhat comparable iPad Air. You have to admire Amazon's moxie here. Apple just moved more than 14 million iPads in its latest quarter -- and that was the older models during a non-holiday quarter. Amazon's willing to butt heads with the top brand in tablets, and it's doing it on a site that it knows will be getting very busy in the coming weeks as holiday shoppers begin to research the best tablet to buy this season. Well played, Amazon. lululemon ahtletica (LULU) -- Blunder When it comes to selling high-end yoga clothing, no one does it as well as lululemon athletica. Sure, there was that embarrassing episode earlier this year where its black Luon yoga pants were too sheer, resulting in the departure of its head of merchandising. However, how do you justify filling that opening by bringing in Kmart's head of apparel to be your new chief products officer? Kmart has struggled with years of declining comps, and it's a lackluster discount department store chain. Even if she was more than qualified for the gig, investor -- and more dangerously customer -- perceptions may mark down lululemon's image. Pitney Bowes (PBI) -- Winner Metered mail may be a fading industry, but that didn't stop Pitney Bowes from hitting a fresh 52-week high this week after posting encouraging quarterly results. The key here is that Pitney Bowes has evolved from being merely a provider of metered mail in an era when folks just aren't mailing physical letters the way that they used to. Pitney Bowes has beefed up its digital commerce solutions business. That's actually growing, helping offset the logical decline on the mail front. The bottom line is that Pitney Bowes' bottom line trounced expectations. Nintendo (NTDOY) -- Blunder Nintendo used to be the video game industry's tastemaker, but these days it seems to be on the outside looking in. It posted its third consecutive quarterly loss this week, and it has only sold 450,000 Wii U consoles through the first six months of its fiscal year. Things won't get any easier this month as the Xbox One and PlayStation 4 hit the market. Nintendo is holding up better with its handheld platform, but it's hard to win a game if you keep reporting losses. Netflix (NFLX) -- Winner Showtime's "Dexter" recently concluded its eight-season run, and now it's returning to Netflix's widening digital vault. Netflix and Showtime parent CBS (CBS) struck a deal to get the entire serialized drama on the popular video service that now has more than 40 million subscribers worldwide. The first four seasons became available on Thursday, and the final four seasons will be accessible in two months. Netflix and its $7.99 monthly plan continues to be one of the best deals in video, and the catalog keeps getting bigger.

AP, Showtime From a high-end apparel retailer making a down-market move to the leading video service adding to its growing library, here are the wonders and blunders of the week. Amazon.com (AMZN) -- Winner Apple (AAPL) may have hit the market with the new iPad Air on Friday, but it was Amazon making the most of the launch -- to promote its own platform. Amazon has spent most of the week pushing its new 8.9-inch Kindle Fire HDX tablet at the top of the popular e-tailer's home page, pitting it against the iPad Air. Amazon points out that its Kindle Fire HDX is 20 percent lighter, packs 950,000 more pixels, and will set shoppers back $120 less than the somewhat comparable iPad Air. You have to admire Amazon's moxie here. Apple just moved more than 14 million iPads in its latest quarter -- and that was the older models during a non-holiday quarter. Amazon's willing to butt heads with the top brand in tablets, and it's doing it on a site that it knows will be getting very busy in the coming weeks as holiday shoppers begin to research the best tablet to buy this season. Well played, Amazon. lululemon ahtletica (LULU) -- Blunder When it comes to selling high-end yoga clothing, no one does it as well as lululemon athletica. Sure, there was that embarrassing episode earlier this year where its black Luon yoga pants were too sheer, resulting in the departure of its head of merchandising. However, how do you justify filling that opening by bringing in Kmart's head of apparel to be your new chief products officer? Kmart has struggled with years of declining comps, and it's a lackluster discount department store chain. Even if she was more than qualified for the gig, investor -- and more dangerously customer -- perceptions may mark down lululemon's image. Pitney Bowes (PBI) -- Winner Metered mail may be a fading industry, but that didn't stop Pitney Bowes from hitting a fresh 52-week high this week after posting encouraging quarterly results. The key here is that Pitney Bowes has evolved from being merely a provider of metered mail in an era when folks just aren't mailing physical letters the way that they used to. Pitney Bowes has beefed up its digital commerce solutions business. That's actually growing, helping offset the logical decline on the mail front. The bottom line is that Pitney Bowes' bottom line trounced expectations. Nintendo (NTDOY) -- Blunder Nintendo used to be the video game industry's tastemaker, but these days it seems to be on the outside looking in. It posted its third consecutive quarterly loss this week, and it has only sold 450,000 Wii U consoles through the first six months of its fiscal year. Things won't get any easier this month as the Xbox One and PlayStation 4 hit the market. Nintendo is holding up better with its handheld platform, but it's hard to win a game if you keep reporting losses. Netflix (NFLX) -- Winner Showtime's "Dexter" recently concluded its eight-season run, and now it's returning to Netflix's widening digital vault. Netflix and Showtime parent CBS (CBS) struck a deal to get the entire serialized drama on the popular video service that now has more than 40 million subscribers worldwide. The first four seasons became available on Thursday, and the final four seasons will be accessible in two months. Netflix and its $7.99 monthly plan continues to be one of the best deals in video, and the catalog keeps getting bigger. NEW YORK (CNNMoney) It's not just income inequality. It's lifespan inequality. And education inequality. And declining economic growth.

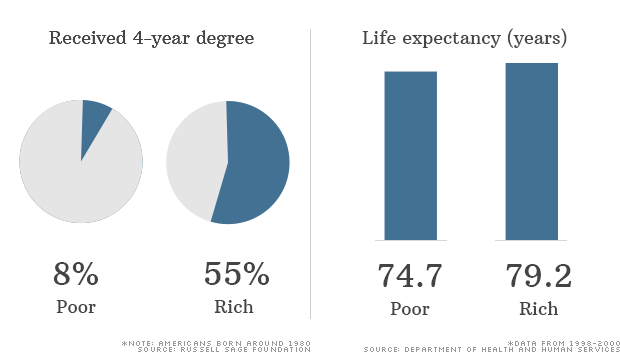

NEW YORK (CNNMoney) It's not just income inequality. It's lifespan inequality. And education inequality. And declining economic growth.  Who's to blame for income inequality?

Who's to blame for income inequality?  “Suddenly, Janet Yellen has regained her status as frontrunner; that signals to the market more policy continuity, which the market takes well,” El-Erian (left), PIMCO CEO and co-CIO, said on CNBC early Monday. “The yield curve gets anchored, you get a bull steepener, the front end does well, repression of volatility, the equity market, the credit market like that, and [what] you get is a broad-based rally, and that’s what we’re getting this morning.”

“Suddenly, Janet Yellen has regained her status as frontrunner; that signals to the market more policy continuity, which the market takes well,” El-Erian (left), PIMCO CEO and co-CIO, said on CNBC early Monday. “The yield curve gets anchored, you get a bull steepener, the front end does well, repression of volatility, the equity market, the credit market like that, and [what] you get is a broad-based rally, and that’s what we’re getting this morning.”