| Sprint (S) | Softbank | BO | 5,939,626 | 39,987,332 | | Nanoviricides (NNVC) | Boniuk M | DIR | 857,142 | 2,999,997 |

DES MOINES, Iowa -- Six Chinese nationals have been indicted as part of an ongoing agriculture espionage case involving the attempted theft of valuable trade secrets from three U.S.-based seed manufacturing companies, federal prosecutors announced Thursday. The indictments came about one week after one of the men, Mo Hailong, was arrested for allegedly conspiring to steal inbred corn seed and transport it to China for use at a China-based seed company. The seeds represent several years of research worth at least $30 million to $40 million, federal prosecutors said. Mo became a lawful permanent resident of the U.S. in 2005 and lives in Miami. Four other defendants are residents of China who were visiting the U.S. on combination business and tourism visas when the attempted thefts reportedly occurred. The sixth suspect is a citizen of Canada and China, and was living in Quebec at the time. Mo had an initial court appearance on Dec. 11 in Miami. The other defendants — Li Shaoming, Wang Lei, Wang Hongwei, Ye Jian and Lin Young — have not appeared in court, said Kevin VanderSchel, first assistant U.S. Attorney for the Southern District of Iowa. He declined to say where the suspects were or whether officials will seek extradition to return them to the U.S. if they are no longer in the country. STORY: Agriculture spies target seed technology, feds say The U.S. has an extradition treaty with Canada but not with China, VanderSchel said. All of the suspects face up to 10 years in prison and fines of $5 million. Mo's attorney, Valentin Rodriguez Jr., did not return a request for comment Thursday. Court documents indicate that at least five of the suspects are employed by the Beijing Dabeinong Technology Group Co. or its corn seed subsidiary Beijing Kings Nower Seed. The attempted theft reportedly occurred between September 2011 and October 2012, when prosecutors say the men took inbred seedlings and mature corn ears from fields across Iowa and Illinois belon! ging to DuPont Pioneer, Monsanto and LG Seeds. They also illegally obtained packages of hybrid corn and made attempts to smuggle the material out of the country, court documents say. VanderSchel declined to comment on whether any corn was successfully removed from the U.S. Inbred seeds are valuable because they pass on drought- and pest-resistant traits to planting seeds that can be grown and harvested. Mo also used an alias to tour DuPont Pioneer's headquarters in Johnston, Iowa, and Monsanto's research facility in Ankeny and to attend a state dinner hosted by Gov. Terry Branstad to welcome Xi Jinping, the then-future president of China, court documents allege. Branstad told reporters Monday that the apparent theft could affect the state's relationship with China, which the governor has sought for decades to forge. "I believe it may present some additional challenges in terms of our relationship between the two countries, but this is a particular incident," Branstad said. VanderSchel said Thursday the Iowa case is independent from other agriculture espionage cases around the country, including one in Kansas that was also made public last week. That case involved the alleged theft of genetically engineered rice.

The budget deal now passed by Congress will set the stage for faster economic growth in 2014, reducing the impact of federal budget cutting on the economy by as much as half, economists say. The measure, adopted by the Senate Wednesday, would reduce the automatic spending cuts scheduled for this year by $45 billion and, partly offset them with different cuts. That could boost growth in 2014 by as much as 0.25%, economist Joel Naroff said. The package does some, but not all, of what ratings agencies and many private economists have been clamoring for, said Moody's Analytics fiscal-policy economist Brian Kessler. Economists have argued that the U.S. should reduce spending cuts now to push the recovery onto more-solid ground, while preparing for longer-term cuts in Social Security and Medicare spending. The bill does defer some spending cuts, but doesn't address the entitlement issues. "It's a small deal, but it's kind of exactly what an economist hoped they would do,'' Kessler said. "Reducing the fiscal drag in the near term is a positive thing.'' The deal isn't a negative for entitlement reform — it simply doesn't address the issue, said Marie Cavanaugh, a managing director in S&P's sovereign ratings group. "This doesn't really go in that direction, but it does show a greater facility for compromise,'' Cavanaugh said. "It would be helpful for creditworthiness if there were a plan in place. You wouldn't need for it to take effect yet because of the fragility of the economy.'' STORY: Senate sends two-year budget deal to Obama Most economists believe the U.S. cut as much as 1.5 percentage points off its growth rate in 2013 because of fiscal policy, both tax increases and spending cuts. With growth running about 2% year-over-year, efforts to reduce the federal deficit cut this year's growth almost by half, according to the International Monetary Fund and other analysts. With no new tax hikes on the horizon, the drag was expected to fall to as little as 0.! 5 percentage points of growth in 2014 even before the deal, Naroff said. That is a big part of the reason many economists expected growth to accelerate anyway in 2014, said Diane Swonk, chief economist at Chicago asset manager Mesirow Financial. The deal would have had a bigger positive impact if it had included an extension of long-term unemployment benefits, which are set to expire on Dec. 28, Swonk said. Some details of the deal, including the expiration of tax credits that give incentives for business investment and hiring veterans, may hurt unless they are later restored as part of a larger tax bill, said Tom Windram, a partner in the national tax practice at accounting firm McGladrey. The expiration of the Work Opportunities Tax Credit "isn't an incentive to hire fewer people. It's an incentive to hire different people,'' Windram said.

Among the companies with shares expected to actively trade in Tuesday’s session are 3M Co.(MMM), Boeing Co.(BA) and Athersys Inc.(ATHX) 3M raised its quarterly dividend by 35%, as the company continued its effort to consistently boost its payouts to shareholders. 3M–whose products include Scotch tape, Nexcare bandages and Post-it Notes–is known as a reliable profit machine. Dividends have increased annually in each of the past 55 years. Shares rose 2.8% to $131 premarket. Boeing said its board authorized a 50% increase to its regular dividend and $10 billion to repurchase its shares over the next two-to-three years, efforts to satisfy shareholders who have been hungry for the company to return some of its soaring earnings to investors. Shares edged up 2.3% to $137.86 premarket. Athersys said its therapy to prevent a type of complication in patients receiving stem cell transplants was granted orphan drug status by European regulators. Shares surged 8.1% to $2.20 in premarket trading. Vringo Inc.(VRNG) said a Germany court found that Chinese telecommunications firm ZTE Corp.(000063.SZ) infringed one of its European patents and is required to pay damages. Shares of the small mobile technology and intellectual-patent firm jumped 10% premarket to $3.40. FuelCell Energy Inc.'s(FCEL) fiscal fourth-quarter loss narrowed as the power-equipment maker reported broad sales growth across all segments and wider gross margins. But the loss was still steeper than expected, sending shares down 11% to $1.65 premarket. KKR(KKR) & Co. said it reached a deal to acquire KKR Financial Holdings LLC(KFN), bringing under its roof the separate, specialty-finance company managed by the private-equity firm that pursues debt investments and other bets. KKR, known for large debt-fueled corporate takeovers, signed an agreement to take over the sister firm in a $2.6 billion all-stock deal, the New York company said. Shares of KKR Financial jumped 28% to $12.12 in premarket trading. Targacept Inc.'s(TRGT) investigational secondary treatment for schizophrenia didn’t show significant improvement in negative symptoms or cognitive function in a Phase 2b trial after 24 weeks. The biopharmaceutical company said it wouldn’t pursue further development of the therapy for the mental illness or for Alzheimer’s Disease. Shares fell 31% to $4.09 premarket. Shares of Rick's Cabaret International Inc.(RICK) jumped after the adult nightclub owner reported improving fiscal fourth-quarter results and projected better profitability in the new fiscal year. The stock jumped 14% to $12.23 premarket. AT&T Inc.(T) agreed to sell its wireline business and statewide fiber network in Connecticut to Frontier Communications Corp.(FTR) for $2 billion as the telecommunications giant continues to focus more on its wireless business. FactSet Research Systems Inc.'s(FDS) fiscal first-quarter profit rose 4.8% as an increase in its client count offset charges from the company’s acquisition of a financial data service company. The company gave a cautious earnings view for the current quarter. Honeywell International Inc.(HON) gave a cautious profit outlook for 2014, while the maker of aerospace, building control and safety products offered a revenue target that fell short of Wall Street’s expectations. Jefferies Group LLC’s fiscal fourth-quarter earnings jumped 68% on strong investment banking revenue. Part of Leucadia National Corp.(LUK), it is often seen as something of a barometer for larger rivals Goldman Sachs Group Inc.(GS) and Morgan Stanley(MS). Chief Executive Richard B. Handler said the company finished the year strongly and fixed income improved significantly from the third quarter. Magellan Health Services(MGLN), which manages public-sector pharmacy benefits programs and other health-care services, offered a preliminary earnings forecast for next year that badly missed Wall Street expectations as share repurchases and the effect of the Affordable Care Act tax are seen hurting the bottom line, while its revenue estimate was stronger than expected. M&T Bank Corp.(MTB) and Hudson City Bancorp Inc.(HCBK) said they expect additional delays in completing their merger deal, and any action isn’t expected to occur until the latter half of 2014. “While all parties are disappointed that the transaction is delayed further, we are gratified that M&T continues to see the value in the Hudson City franchise,” said Hudson City CEO Ronald E. Hermance Jr. Sanderson Farms Inc.’s fiscal fourth-quarter earnings soared as the company continued to gain from a stronger poultry market, with chicken-breast prices improving and feed costs dropping. Earnings missed expectations, though the top line beat. Starbucks Corp. said it expects record purchases and activations of its Starbucks Cards on Thursday, as the coffee company anticipates a reprise of last year’s Thursday before Christmas, when more that 2 million of the cards were purchased in the U.S. and Canada.

Asian stock markets moved higher on Tuesday as upbeat economic data from the U.S. and Europe lifted investor confidence ahead of the Federal Reserve's policy meeting. The region took its lead from strong overnight gains in the U.S. and Europe, as stocks responded well to signs of improvement in the global economy. In Europe, markets surged after preliminary data showed that manufacturing in the euro zone grew at its fastest rate in December since May 2011.  Shutterstock  Enlarge Image The European data followed figures for China from earlier on Monday, which showed slowing growth in factory activity in Asia's largest economy in December — a contributor to the region's declines in the previous session. In the U.S., industrial production in November exceeded its pre-recession peak, prompting a 0.8% climb in the Dow Jones Industrial Average. The data came just before the Federal Reserve starts its much-anticipated policy meeting on Tuesday, where there are some expectations that the central bank could start to withdraw its stimulus when it concludes on Wednesday — a process that has become known as tapering. The positive sentiment in Asia was evident in the yen. Although the dollar (USDJPY) lost 0.2% overnight against its Japanese counterpart, it did manage to climb back above the ¥103 mark, which it lost in Asian trading on Monday. The yen recently traded at ¥103.05 to the dollar. The softer local currency helped Japanese stocks rebound after Monday's selloff, with the Nikkei (JP:NIK) up 1%. South Korea's Kospi (KR:SEU) was up 0.9% and Australia's S&P/ASX 200 (AU:ASX) gained 0.5%. In China, Hong Kong's Hang Seng Index (HK:HSI) rose 0.4% and the Shanghai Composite (CN:SHCOMP) was up 0.1% in the mainland. The Australian dollar rose after minutes from the Reserve Bank of Australia's December meeting showed that the central bank was prudent to keep rates steady to gauge the effect of previous cuts, though it did say that the Australian dollar was "uncomfortably high". The Aussie (AUDUSD) moved as high as 89.54 U.S. cents from 89.33 U.S. cents before the minutes were released, and was last at 89.47 U.S. cents.

A rare opportunity came my way in October when Google unveiled its Internet-surfing, voice and gesture-controlling eye glasses to the public for the first time in Durham, N.C., near where I live. I'd heard (and written) about wearable technology and its power to access many apps and programs on a computer or smartphone without using hands. But it wasn't until Google Glass was on my face, and a Glass Guide was talking me through its functions and features, that I really got it. Glass is like an add-on to my brain. That got me thinking about the 10,000 men and women given the chance to buy Glass and test it in the past six months. These "Explorers" got a head start on developing the apps, called 'Glassware,' that will make the gadget the biggest innovation in mobile technology since the cellphone. They are people and businesses that top-tier venture capitalists at Google Ventures, Andreessen Horowitz and Kleiner Perkins Caufield & Byers have pledged to fund through their new investment syndicate, Glass Collective. Other investors are expected to flock to Glassware when the device launches in 2014. Who are these Explorers? What business opportunities do they see? Meet four enthusiastic Glassware developers convinced they're building the future of mobile. • Tim Moore, a social media strategist in Wilmington, N.C., got his Glass in June, and immediately set to work solving what he believes to be Glass's biggest deficiency. Moore couldn't wear Glass with his prescription eyeglasses, drastically reducing its usefulness. Working with New York eyewear manufacturer Rochester Optical, he will introduce the first prescription lenses and designer frames for Glass at the Wearable Technologies Conference in Munich in January. Moore hasn't stopped there. He's interviewed dozens of doctors and firefighters, exploring ways to use Glass in medical practice or during emergency calls. He also launched a free consulting service called Venture Glass to provide resources ! for people developing Glassware. He might invest or partner with those contacting him for help. But mostly, he's listening to their ideas, offering advice and helping them meet other Glass experts and developers. "I didn't see a resource out there," he says. "You had to be Google or a big company with real close connections to Google to even have an opportunity. I thought it should be a level playing field." • Cecilia Abadie, a San Diego software developer, has launched Byte An Atom Research with a pair of co-founders. Their first product is LynxFit, a fitness application that acts as a virtual personal trainer, giving video and voice instructions during a workout and measuring the speed and direction of movements via Glass's accelerometer and gyroscope. Abadie's team is in discussions with major fitness brands about releasing content via the application, helping to create a business around it, she says. • Keith Myers didn't sleep for a week after he won a Twitter competition to receive Glass in July. The Miami software developer had one wish for Glass: that it notify him of potential hurricanes in his hometown, wherever he might be traveling in the world. Free and paid versions of that application are ready to launch whenever Glass does.Myers is working on a bar-code scanning application for servers in massive data centers. Glass would scan a code on a server and show an information technology manager all the diagnostics, simplifying maintenance. Myers expects to become a full-time Glass and wearable device developer in the next year. • Barry Schwartz and his team at Web development firm RustyBrick in West Nyack, N.Y have built Glassware to serve their clients and their passions. For EZContacts.com, Rusty Brick built a promotional app in which Glass users take an eye exam and share it through social media. For MarketingLand.com, Glassware pushes out content from the website as soon as it's published. For fun, Schwartz's team built Glassware that not! ifies Jew! ish people about ways to practice their faith throughout the day. It locates the nearest temples and kosher restaurants wherever a person might be in the world. Schwartz sees his biggest opportunity in helping emergency room doctors. He and a medical client are discussing ways that Glass could deliver patient records — making treatment more efficient — or record procedures for training or tracking purposes. Schwartz has advice for anyone dreaming up a business around Glassware: Consider how your data or content could help people in a hands-free, on-demand setting. "Think about what people want and then send it to them when they need it," Schwartz says. "That's how to think about Glass." Laura Baverman is a Raleigh, N.C.-based business journalist covering start-ups and entrepreneurship for regional and national publications. She previously covered entrepreneurship for the Cincinnati Enquirer, a Gannett newspaper. Baverman can be reached via e-mail at lbaverman@gmail.comor Twitter @laurabaverman.

Bloomberg Investors for years have been searching in vain for a formula to replicate Warren Buffett's legendary returns over the past 50 years. The wait could be over. A new study that claims to have uncovered this formula was published last month by the National Bureau of Economic Research in Cambridge, Mass. Its authors, all of whom have strong academic credentials, work for AQR Capital Management, a firm that manages several hedge funds and other investment offerings and has $90 billion in assets. The study's authors analyzed Buffett's record since he acquired Berkshire Hathaway (BRK.A) (BRK.B) in 1964. Their formula, which has more than a dozen individual components, comes in two major parts. Click to Play  A TV season in two days? How we binge watch How quickly will you devour the new season of 'House of Cards'? WSJ's John Jurgensen joins digits with a look at what a recent survey by Netflix says about how we watch TV now. The first is a "focus on cheap, safe, quality stocks," defined as those that have exhibited below-average volatility and sport low ratios of price-to-book value — a measure of net worth. In addition, the researchers looked for stocks whose profits are growing at an above-average pace and that pay out a significant portion of their earnings as dividends. The second part of the formula will raise eyebrows: It calls for investing in these stocks "on margin" — that is, borrowing money to buy more shares than could otherwise be purchased. To match Buffett's long-term return, the researchers found, a portfolio would need to be 60% on margin — borrowing enough so that it owned $160 of "cheap, safe, quality stocks" for every $100 of portfolio value. Andrea Frazzini, one of the study's authors, a finance professor at New York University and a vice president at AQR, said the Berkshire portfolio has, on average, been leveraged to a similar extent through Buffett's career. It can be easy to overlook the extent of this leverage, since Buffett is able to borrow from other parts of his business. But that doesn't mean the company isn't still leveraged, Frazzini argues. According to its most recent annual report, for example, the total value of Berkshire's holdings are double the company's net worth, implying that its current leverage is about 2-to-1 — somewhat higher than its long-term average. Employing margin can magnify profits, of course. It also increases potential losses when things go wrong. But note that the formula combines a heavy use of margin with stocks that tend to be much less risky than the market, so the net result can still be a portfolio that is no riskier than the market as a whole. 'Margin call' risks To be sure, a heavily margined portfolio will always run the risk that, if its holdings fall enough, of getting a "margin call" — the need to come up with additional cash. Berkshire Hathaway has been able to sidestep that risk over the last 50 years. Despite a heavily reliance on leverage, its worst return in any calendar year was a loss of 9.6%. And its book value has been less volatile than the S&P 500 (SPX) . Volatility is a common measure of a portfolio's risk. One factor that is conspicuous in its absence from the formula is anything to account for Buffett's significant investments in privately owned companies. But that isn't necessary, according to the researchers, because the public companies in which he has invested have outperformed the private ones. MarketWatch Interactive: CUTTING THE CABLE CORD Your browser does not support inline frames or is currently configured not to display inline frames. /conga/story/2013/12/cutting_the_cord.html 290225 This is somewhat surprising, given that Buffett has often trumpeted his abilities to pick good managers. Yet the researchers nevertheless find that his "returns are more due to stock selection than to his effect on management." (A Berkshire Hathaway spokeswoman said that Buffett declined to be interviewed.)

Walmart, which operates 11,098 locations around the world, has opened three locations on college campuses since 2011, according to company spokesperson Deisha Barnett. The retailer most recently opened a location on Georgia Tech's campus in August, joining the University of Arkansas at Fayetteville and Arizona State University. Ivy League students interviewed for this story overwhelmingly opposed the idea of a Walmart opening up at their schools. Most said they do not think the lower prices and conveniences of a Walmart would be worth the potential harm to local businesses in their college towns. Expressing fears that the chain would change her community of Cambridge, Mass. for the worse, Diana Chen, a sophomore at Harvard, said "My personal opinion would be a 'no way' on our campus." Like Chen, Oliver Kim, a junior at Harvard, said he worries that local businesses — unable to stay competitive with Walmart's prices — could suffer if the company were to open up shop at Harvard. "Harvard Square has a nice, bohemian, historic feel that would be ruined by a big Walmart," he said. "The convenience and low prices might be nice, but I don't think the cost to the Harvard community would be worth it." Beyond considering the impact Walmart might have on local businesses, Jessica Solis, a sophomore at Brown, said she would not welcome a Walmart on campus because "its presence would really detract from the homey, domestic feel that Brown offers." Alex Schindele, a sophomore at Princeton, echoed Solis' sentiments, saying he thinks a Walmart on Princeton's campus would hurt the community's "small-town feel." In Manhattan, Dan Schlosser, a sophomore at Columbia, agreed. A big part of what makes New York special, he said, is "the rich, cultural history of the shops and restaurants." Although he thought the opening of! a Walmart could give college students access to low-cost, discounted items, it would not be worth "the inevitable damage to local, small businesses." Others said they simply could not imagine what a Walmart on campus would look like. At Cornell, Benny Carriel, a senior, said a Walmart store would seem "extremely out of place" with Cornell's Gothic towers and Victorian buildings. Yet not all students expressed distaste at the idea of a Walmart opening up near them. Sean Haufler, a senior at Yale, said that while he believes that Walmart is generally harmful to local economies — citing its potential to "kill small businesses and drive down wages" — New Haven's economy could actually benefit from a Walmart. "Downtown New Haven doesn't have any grocery stores. There are convenient shops and delis, but there are scant options nearby for healthy, affordable groceries," Haufler said. "Connecticut has a huge wealth gap, and I believe the gap is perpetuated by the lack of grocery options for low-income households. Since no local businesses have provided a viable solution, I think a Walmart could be a net good for New Haven." The addition of a Walmart on campus would help with the frequent need for school supplies, according to Kevin Kim, a sophomore at Dartmouth. "In the beginning of every term, I see students — especially international students and incoming freshmen — [struggling] to get their college supplies from local stores. Opening a Walmart on campus would definitely make this process much easier and faster," said Kevin Kim, a sophomore at Dartmouth. A University of Pennsylvania student was ambivalent. "I do a lot of shopping online — as do other college students — because you can shop at any time of the day and because very few kids here have cars," said Aaron Lidawer, a sophomore at UPenn. Would he visit a Walmart if it were on his campus? "Maybe," Lidawer said. "But you wouldn't be able to buy big things there anyway, since ! you'd hav! e to walk with them [to bring them back to your dorm]." Akane Otani is a senior at Cornell University

Check out Jim Cramer's latest trading recommendations on "Action Alerts Plus". (Updates from 10:56 a.m. ET with closing information.) NEW YORK (TheStreet) -- Here's what Jim Cramer had to say on CNBC's "Squawk on the Street" Wednesday.

Wells Fargo upgraded Groupon (GRPN) to buy from hold. Cramer said the analyst sees GRPN dominating mobile and "obviously it's got some upside." GRPN rose 1% to $10.14.

Goldman Sachs likes Access Midstream Partners (ACMP). Cramer called it one of the most "consistent" pipeline companies with its 4% dividend yield. ACMP fell 1% to $50.87.

Citigroup raised its price target on Netflix (NFLX) to $390 from $355. Cramer said the anti-momentum traders might not like the call but Citigroup says it's going higher "so buy it." NFLX was nearly 1% higher at $363.98.

Bernstein likes Kellogg (K) and suggested investors consider a pairs trade, buying K and selling General Mills (GIS). "Good luck with that," Cramer said, saying both are good companies. K was unchanged at $61.04.

Shares of Burlington Stores (BURL) got hit Tuesday on poor company guidance. Cramer suggested investors "buy G-III Apparel Group (GIII)." BURL jumped 8.3% to $28.07.

UBS says United Technologies (UTX) will miss earnings estimates next quarter, but Cramer disagreed. He said the stock is "one of the great winners this period" and he doesn't want to bet against it. UTX fell 2.1% to $108.66. To sign up for Jim Cramer's free Booyah! newsletter, with all of his latest articles and videos, please click here. -- Written by Bret Kenwell in Petoskey, Mich. Follow @BretKenwell

Bank Rakyat Indonesia (BKRKY) (Persero) Tbk PT, a leading commercial bank and microfinance lender in Indonesia, declined in the third quarter. Recent stock performance was largely attributable to a significant drop in the Indonesian Rupiah. While we believe the company's fundamentals and competitive position remain sound, the country suffered a larger than expected deterioration in its current account deficit, leading to a weaker currency and higher interest rates, which negatively impacted its local equity market. (Michael Kass) From Ron Baron's Baron Funds third quarter 2013 report.

Also check out: Ron Baron Undervalued Stocks Ron Baron Top Growth Companies Ron Baron High Yield stocks, and Stocks that Ron Baron keeps buying

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

Subscribe via Email  Subscribe RSS Comments Please leave your comment: More GuruFocus Links | Latest Guru Picks | Value Strategies | | Warren Buffett Portfolio | Ben Graham Net-Net | | Real Time Picks | Buffett-Munger Screener | | Aggregated Portfolio | Undervalued Predictable | | ETFs, Options | Low P/S Companies | | Insider Trends | 10-Year Financials | | 52-Week Lows | Interactive Charts | | Model Portfolios | DCF Calculator | RSS Feed  | Monthly Newsletters | | The All-In-One Screener | Portfolio Tracking Tool | 183,785 Users Have Received Their FREE 12-Page Warren Buffett Portfolio Report Get Yours FREE Here MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies | | Warren Buffett Portfolio | Ben Graham Net-Net | | Real Time Picks | Buffett-Munger Screener | | Aggregated Portfolio | Undervalued Predictable | | ETFs, Options | Low P/S Companies | | Insider Trends | 10-Year Financials | | 52-Week Lows | Interactive Charts | | Model Portfolios | DCF Calculator | RSS Feed  | Monthly Newsletters | | The All-In-One Screener | Portfolio Tracking Tool | BKRKY STOCK PRICE CHART  12.15 (1y: -19%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'BKRKY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355292000000,14.99],[1355378400000,14.867],[1355464800000,14.34],[1355724000000,14.58],[1355810400000,14.38],[1355896800000,14.48],[1355983200000,14.38],[1356069600000,14.432],[1356328800000,14.493],[1356501600000,14.54],[1356588000000,14.14],[1356674400000,14.404],[1356933600000,14.5],[1357106400000,14.5],[1357192800000,14.697],[1357538400000,15.16],[1357624800000,15.5],[1357711200000,15.35],[1357797600000,15.35],[1357884000000,15.47],[1358143200000,15.45],[1358229600000,15.8],[1358316000000,16.31],[1358402400000,16.44],[1358488800000,16.485],[1358834400000,16.02],[1358920800000,16.15],[1359007200000,16.2],[1359093600000,16.17],[1359352800000,16.332],[1359439200000,16.27],[1359525600000,16.27],[1359612000000,16.39],[1359698400000,16.601],[1359957600000,16.61],[1360044000000,17.05],[1360130400000,16.83],[1360216800000,16.92],[1360303200000,16.91],[1360562400000,17.04],[1360648800000,17.57],[1360735200000,17.74],[1360821600000,17.86],[1360908000000,18.13],[1361253600000,17.75],[1361340000000,17.6],[1361426400000,17.58],[1361512800000,17.75],[1361772000000,17.6],[1361858400000,17.6],[1361944800000,18.65],[1362031200000,19.12],[1362117600000,18.704],[1362376800000,18.05],[1362463200000,18],[1362549600000,18.2],[1362636000000,18.35],[1362722400000,18.6],[1362978000000,18.5],[1363064400000,18.4],[1363150800000,18.45],[1363237200000,18.4],[1363323600000,18.233],[1363582800000,17.51],[1363669200000,17.7],[1363755600000,17.76],[1363842000000,18.05],[1363928400000,17.56],[1364187600000,17.5],[1364274000000,17.6],[1364360400000,18],[1364446800000,18.25],[1364792400000,17.75],[1364878800000,17.86],[1364965200000,17.76],[1365051600000,17.83],[1365138000000,17.542],[1365397200000,17.44],[1365483600000,17.71],[1365570000000,17.71],[1365656400000,17.66],[1365742800000,17.41],[1366002000000,16.68],[1366088400000,17.2],[1366174800000,17.625],[1366261200000,17.635],[1366347600000,18.095],[1366606800000,17.75],[1366693200000,17.97],[1366779600000,17.871],[1366866000000,18.3],[1366952400000,18.75],[1367211600000,19.0! 2],[1367298000000,19.19],[1367384400000,19.9],[1367470800000,19.32],[1367557200000,18.89],[1367816400000,18.8],[1367902800000,19.35],[1367989200000,19.4],[1368075600000,19.44],[1368162000000,19.34],[1368421200000,18.9],[1368507600000,19.3],[1368594000000,19],[1368680400000,18.6],[1368766800000,19.5],[1369026000000,19.228],[1369112400000,19.2],[1369198800000,19.14],[1369285200000,19.05],[1369371600000,18.55],[1369717200000,18.62],[1369803600000,18.48],[1369890000000,18.282],[1369976400000,17.51],[1370235600000,17.84],[1370322000000,17.45],[1370408400000,17.31],[1370494800000,17.43],[1370581200000,16.52],[1370840400000,16.2],[1370926800000,15.15],[1371013200000,15.13],[1371099600000,15.35],[1371186000000,15.5],[1371445200000,15.9],[1371531600000,16.64],[1371618000000,15.76],[1371704400000,14.31],[1371790800000,14.5],[1372050000000,14.43],[1372136400000,13.95],[1372222800000,15],[1372309200000,14.93],[1372395600000,15.38],[1372654800000,15.75],[1372741200000,15.7],[1372827600000,15.11],[1373000400000,15.05],[1373259600000,14.85],[1373346000000,14.45],[1373432400000,14.19],[1373518800000,15.49],[1373605200000,15.78],[1373864400000,15.61],[1373950800000,15.7],[1374037200000,15.95],[1374123600000,16.28],[1374210000000,15.99],[1374469200000,15.7],[1374555600000,16],[1374642000000,15.45],[1374728400000,15.599],[1374814800000,15.543],[1375074000000,15.29],[1375160400000,15.98],[1375246800000,15.83],[1375333200000,15.9],[1375419600000,16.093],[1375678800000,15.8],[1375765200000,15.7],[1375851600000,15.71],[1375938000000,15.6],[1376024400000,16.

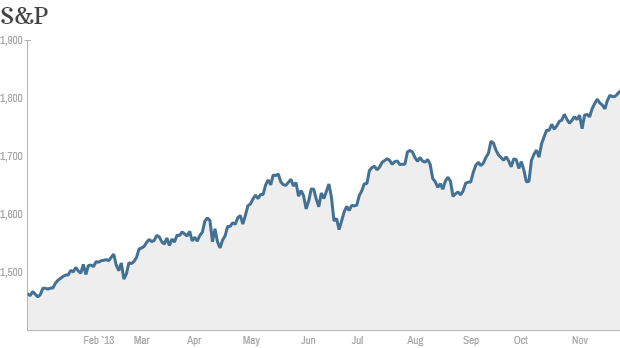

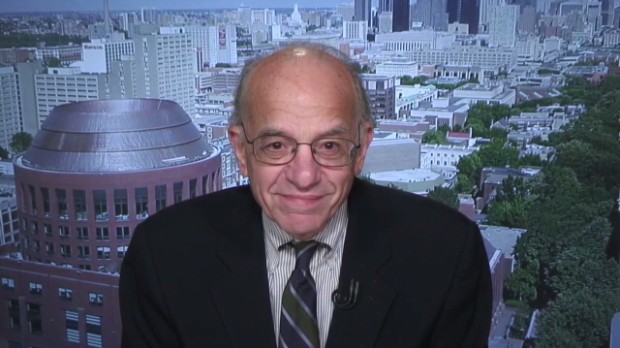

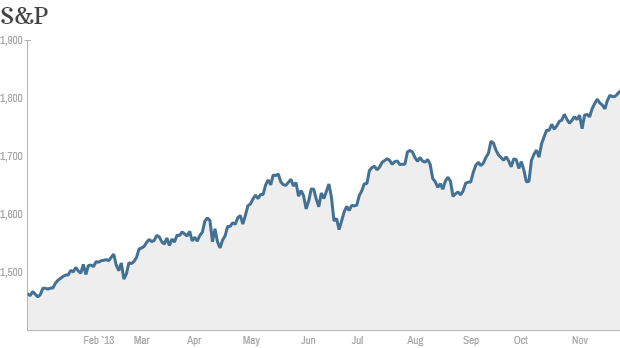

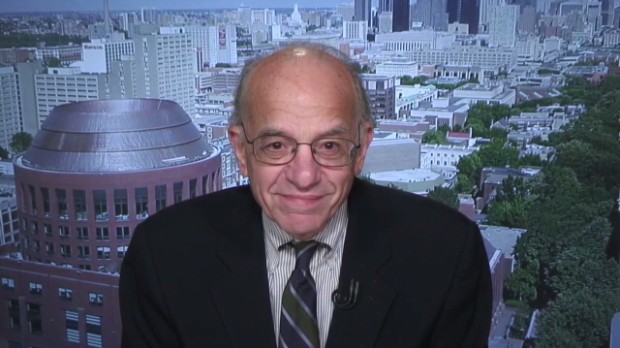

Click the chart for more market data. NEW YORK (CNNMoney) It was an incredible November for stocks in what's been an amazing year for the market. Will the rally continue in December? The Dow Jones industrial average and the Nasdaq both ended November with a gain of about 3.5%. The S&P 500 advanced almost 3%. The Dow and S&P 500 are near record highs, while the Nasdaq rose above 4,000 last week for the first time in 13 years. So far this year, the S&P 500 has soared nearly 27% in the latest phase of a bull market that started in March, 2009. If history is any guide, stocks should head even higher in December. Over the past 30 years, the S&P 500 has gained in December 80% of the time, according to data from Schaeffer's Investment Research. Stocks often benefit in the last month of the year as fund managers bulk up on the best performers in an attempt to "window dress" portfolios. But with prices at record highs, there are growing concerns that stock valuations are becoming stretched. The S&P 500 is currently trading at more than 15 times next year's earnings estimates, which is slightly above the long-term average. The week ahead brings a slew of economic data that could give investors a better sense of when the Federal Reserve may begin to scale back, or taper, its massive stimulus program. The main event will be Friday's jobs report for November. The Fed has said that continued improvement in the labor market could trigger a reduction in its monthly purchases of $85 billion in Treasury bonds and mortgage-backed securities. Job growth was surprisingly strong in October, despite a temporary shutdown of several parts of the federal government.  Famous bull: Market has room to run Investors will get a second reading on third-quarter U.S. gross domestic product on Thursday. Data on manufacturing and new home sales are also on tap this week. The economy has been gradually recovering over the past few years and corporate profits have soared. But many experts believe the bigg! est driver of the nearly five-year-old bull market has been the Fed's stimulus policies and record low interest rates. While most investors expect the Fed to stay on hold into next year, some believe there's a chance it could announce plans to taper at its policy meeting later this month.

After spiking higher on the news of both non-farm payrolls and unemployment beating expectations, the greenback reversed lower during the New York trading session. U.S. stock indexes also rallied on the news initially and have been able to hold on to some of their gains. The Standard & Poor's 500 index has risen by over 25 percent in 2013. U.S. Employment Report The U.S. Bureau of Labor Statistics reported on Friday that payrolls increased by 203,000 in November, beating analyst expectations of 180,000. The figure came in modestly higher than October's upwardly revised reading of 200,000. The November unemployment rate fell to 7 percent, its lowest level in five years, beating analyst expectations of 7.2 percent. The reading for the month of October was 7.3 percent. The decline in unemployment to 7.0 percent from 7.3 percent was impacted considerably by the return of federal workers after the government shutdown in October. Related: U.S. Dollar Indecisive After ADP, Trade Balance and ISM The broader U-6 unemployment rate fell to 13.2 percent, from 13.8 percent. This measure also includes part-time workers who want to work full-time, marginally-attached workers and those who have stopped looking for work. The Fed has stated that it won't raise interest rates until after the unemployment rate reaches a threshold of 6.5 percent or lower. However, Fed policymakers have also asserted that reaching 6.5 percent would not necessarily bring about immediate interest rate increases. U.S. GDP Yesterday, the Commerce Department reported that in the third quarter, the U.S. economy grew faster than initially estimated. Gross domestic product increased at a 3.6 percent annualized rate, revised higher from an initial estimate of 2.8 percent. December FOMC Meeting Analysts are pondering whether the recent positive economic data out of the U.S. is sufficient for the Fed to scale back their $85 billion-a-month bond buying program at the December 17-18 meeting. While analysts are divided on whether the Fed will taper in December, the odds are likely to have increased after today's employment data. Speaking with Bloomberg TV in late November, James Bullard, president of the Federal Reserve Bank of St. Louis, said, "A strong jobs report, I think, would increase the probability some for a December taper." ICE US Dollar Index Daily Chart  Posted-In: News Forex Economics Federal Reserve Markets Best of Benzinga (c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved. Around the Web, We're Loving... Lightspeed Trading Presents: Thunder and Tubleweeds: Trading Techniques for the New Market Enviroment Pope Francis Rips 'Trickle-Down' Economics Come See How the Pro's Trade in this Exclusive Webinar Wynn, MGM, Other Casino Giants Vying For U.S. Turf What Should You Know About AMZN? Most Popular Luxury Real Estate Foreclosures Up 61 Percent #PreMarket Primer: Thursday, December 5: Apple & China Mobile Ink Deal 3 Reasons Every Family Office Should Own Petrobras Brasileiro Market Wrap For November 4: Economy Is Steady, Tapering Could Be Around The Corner Five Star Stock Watch: Sirius XM Holdings UPDATE: Morgan Stanley Reiterates on InterOil as More Clarity is Needed Related Articles () Consider This Small Cap Stock for December Uncertainty Toyota Says It Is Modifying the Camry After Crash-Test Results Five Star Stock Watch: Netflix, Inc. Dollar Indecisive After Positive U.S. Employment Report Analyst Says Spotify's Move Toward Free Mobile Aimed At Disrupting Pandora's Sound Exchange Negotiations Bank of America to Report Q4 2013 Results on January 15, 2014 View the discussion thread. Partner Network

Stock prices for United Continental (NYSE: UAL), US Airways Group (NYSE: LCC), and Delta Airlines (NYSE: DAL) have soared for 2013. Pretty remarkable, when you consider the level of debt each of these companies is carrying. When the market turns, as it always does, the heavy leverage will be a tremendous burden on the ability of all of these airlines to compete and survive. Since the industry's deregulation in 1978 more than 200 air carriers have filed for bankruptcy. US Airways has done it twice. Delta Airlines did it in 2005 and, for United Airlines, it was in 2002. American Airlines was the last legacy airline to file for bankruptcy with its Chapter 11 petition in November 2011. All borrowed way too much to be able to survive. Related: Time to Chow Down on this High-Dividend, Low-Debt Takeover Candidate? A useful way to determine how well a company is being managed for debt and other considerations is to compare it with the "best practices" in the industry. Spirit Airlines (NASDAQ: SAVE) and Alaska Airlines (NYSE: ALK) are, by far, the best run airlines-- with each having a profit margin of around 9.50 percent. The debt-to-equity ratio for Alaska Airlines is 0.50. Spirit Airlines has no debt. By contrast, United Airlines has a negative profit margin of 0.50 percent and a debt-to-equity ratio of 6.98. That means it required almost seven dollars in borrowing to produce each dollar of equity for those owning the stock. US Airways Group has a debt-to-equity ratio of 3.93 and a profit margin of 4.10 percent. The debt-to-equity ratio for Delta Airlines is 86.86 with a profit a profit margin of 5.10 percent. The airlines industry is one that does not hold up well with too much debt. Fuel makes up about 40 percent of fixed expenses, and it appears to be staying at a high level. Revenues are also unpredictable, as passenger traffic fluctuates with the economy. An unstable revenue stream with high fixed costs is a classic case of borrowing short-term and lending long-term, which should always be avoided. Writing on this subject in The Wall Street Journal in 2009, Mike Milken warned that "even a dollar of debt may be too much for some companies. Over the past four decades, many companies have struggled with the wrong capital structures. During cycles of credit expansion, companies have often failed to build enough liquidity to survive the inevitable contractions." "Especially vulnerable." he added, "are enterprises with unpredictable revenue streams that end up with too much debt during business slowdowns. It happened 40 years ago, it happened 20 years ago, and it's happening again. Over-leveraging in many industries -- especially airlines, aerospace and technology -- started in the late 1960s." As detailed in a previous article on Benzinga, it is far better to invest in companies with clean or lean balance sheets. That is especially so for industries like the airlines, that have unpredictable income streams with high fixed costs. Before taking off with US Airways Group, Delta Airlines and United Continental, investors should be very wary of the debt burdens that have a history of forcing air carriers into a crash landing. Posted-In: airline bankruptcy Airline Industry airlines Mike MilkenLong Ideas News Wall Street Journal Small Cap Analysis Commodities Technicals Travel Economics Markets Media Trading Ideas General Interview (c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved. Around the Web, We're Loving... Lightspeed Trading Presents: Thunder and Tubleweeds: Trading Techniques for the New Market Enviroment Pope Francis Rips 'Trickle-Down' Economics Come See How the Pro's Trade in this Exclusive Webinar Wynn, MGM, Other Casino Giants Vying For U.S. Turf What Should You Know About AMZN? Most Popular The Apple - China Mobile Deal By The Numbers Why Tesla Was Up 16 Percent Tuesday The 10 Apple Acquisitions of 2013 J.C. Penney: What The Analysts Are Saying #PreMarket Primer: Thursday, December 5: Apple & China Mobile Ink Deal 3 Reasons Every Family Office Should Own Petrobras Brasileiro Related Articles (ALK + DAL) High-Flying, High-Debt Airlines Will Be Forced Back Down to Earth, Again Cowen and Company Believes Sell-Off is Unwarranted for Delta Air Lines Airline Stocks Under Pressure Amid Recent Run-Up in Crude Oil, News of Better-Than-Expected Auto Sales Data

| |

Shutterstock

Shutterstock  Enlarge Image

Enlarge Image  Bloomberg

Bloomberg  A TV season in two days? How we binge watch

A TV season in two days? How we binge watch

12.15 (1y: -19%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'BKRKY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355292000000,14.99],[1355378400000,14.867],[1355464800000,14.34],[1355724000000,14.58],[1355810400000,14.38],[1355896800000,14.48],[1355983200000,14.38],[1356069600000,14.432],[1356328800000,14.493],[1356501600000,14.54],[1356588000000,14.14],[1356674400000,14.404],[1356933600000,14.5],[1357106400000,14.5],[1357192800000,14.697],[1357538400000,15.16],[1357624800000,15.5],[1357711200000,15.35],[1357797600000,15.35],[1357884000000,15.47],[1358143200000,15.45],[1358229600000,15.8],[1358316000000,16.31],[1358402400000,16.44],[1358488800000,16.485],[1358834400000,16.02],[1358920800000,16.15],[1359007200000,16.2],[1359093600000,16.17],[1359352800000,16.332],[1359439200000,16.27],[1359525600000,16.27],[1359612000000,16.39],[1359698400000,16.601],[1359957600000,16.61],[1360044000000,17.05],[1360130400000,16.83],[1360216800000,16.92],[1360303200000,16.91],[1360562400000,17.04],[1360648800000,17.57],[1360735200000,17.74],[1360821600000,17.86],[1360908000000,18.13],[1361253600000,17.75],[1361340000000,17.6],[1361426400000,17.58],[1361512800000,17.75],[1361772000000,17.6],[1361858400000,17.6],[1361944800000,18.65],[1362031200000,19.12],[1362117600000,18.704],[1362376800000,18.05],[1362463200000,18],[1362549600000,18.2],[1362636000000,18.35],[1362722400000,18.6],[1362978000000,18.5],[1363064400000,18.4],[1363150800000,18.45],[1363237200000,18.4],[1363323600000,18.233],[1363582800000,17.51],[1363669200000,17.7],[1363755600000,17.76],[1363842000000,18.05],[1363928400000,17.56],[1364187600000,17.5],[1364274000000,17.6],[1364360400000,18],[1364446800000,18.25],[1364792400000,17.75],[1364878800000,17.86],[1364965200000,17.76],[1365051600000,17.83],[1365138000000,17.542],[1365397200000,17.44],[1365483600000,17.71],[1365570000000,17.71],[1365656400000,17.66],[1365742800000,17.41],[1366002000000,16.68],[1366088400000,17.2],[1366174800000,17.625],[1366261200000,17.635],[1366347600000,18.095],[1366606800000,17.75],[1366693200000,17.97],[1366779600000,17.871],[1366866000000,18.3],[1366952400000,18.75],[1367211600000,19.0! 2],[1367298000000,19.19],[1367384400000,19.9],[1367470800000,19.32],[1367557200000,18.89],[1367816400000,18.8],[1367902800000,19.35],[1367989200000,19.4],[1368075600000,19.44],[1368162000000,19.34],[1368421200000,18.9],[1368507600000,19.3],[1368594000000,19],[1368680400000,18.6],[1368766800000,19.5],[1369026000000,19.228],[1369112400000,19.2],[1369198800000,19.14],[1369285200000,19.05],[1369371600000,18.55],[1369717200000,18.62],[1369803600000,18.48],[1369890000000,18.282],[1369976400000,17.51],[1370235600000,17.84],[1370322000000,17.45],[1370408400000,17.31],[1370494800000,17.43],[1370581200000,16.52],[1370840400000,16.2],[1370926800000,15.15],[1371013200000,15.13],[1371099600000,15.35],[1371186000000,15.5],[1371445200000,15.9],[1371531600000,16.64],[1371618000000,15.76],[1371704400000,14.31],[1371790800000,14.5],[1372050000000,14.43],[1372136400000,13.95],[1372222800000,15],[1372309200000,14.93],[1372395600000,15.38],[1372654800000,15.75],[1372741200000,15.7],[1372827600000,15.11],[1373000400000,15.05],[1373259600000,14.85],[1373346000000,14.45],[1373432400000,14.19],[1373518800000,15.49],[1373605200000,15.78],[1373864400000,15.61],[1373950800000,15.7],[1374037200000,15.95],[1374123600000,16.28],[1374210000000,15.99],[1374469200000,15.7],[1374555600000,16],[1374642000000,15.45],[1374728400000,15.599],[1374814800000,15.543],[1375074000000,15.29],[1375160400000,15.98],[1375246800000,15.83],[1375333200000,15.9],[1375419600000,16.093],[1375678800000,15.8],[1375765200000,15.7],[1375851600000,15.71],[1375938000000,15.6],[1376024400000,16.

12.15 (1y: -19%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'BKRKY', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355292000000,14.99],[1355378400000,14.867],[1355464800000,14.34],[1355724000000,14.58],[1355810400000,14.38],[1355896800000,14.48],[1355983200000,14.38],[1356069600000,14.432],[1356328800000,14.493],[1356501600000,14.54],[1356588000000,14.14],[1356674400000,14.404],[1356933600000,14.5],[1357106400000,14.5],[1357192800000,14.697],[1357538400000,15.16],[1357624800000,15.5],[1357711200000,15.35],[1357797600000,15.35],[1357884000000,15.47],[1358143200000,15.45],[1358229600000,15.8],[1358316000000,16.31],[1358402400000,16.44],[1358488800000,16.485],[1358834400000,16.02],[1358920800000,16.15],[1359007200000,16.2],[1359093600000,16.17],[1359352800000,16.332],[1359439200000,16.27],[1359525600000,16.27],[1359612000000,16.39],[1359698400000,16.601],[1359957600000,16.61],[1360044000000,17.05],[1360130400000,16.83],[1360216800000,16.92],[1360303200000,16.91],[1360562400000,17.04],[1360648800000,17.57],[1360735200000,17.74],[1360821600000,17.86],[1360908000000,18.13],[1361253600000,17.75],[1361340000000,17.6],[1361426400000,17.58],[1361512800000,17.75],[1361772000000,17.6],[1361858400000,17.6],[1361944800000,18.65],[1362031200000,19.12],[1362117600000,18.704],[1362376800000,18.05],[1362463200000,18],[1362549600000,18.2],[1362636000000,18.35],[1362722400000,18.6],[1362978000000,18.5],[1363064400000,18.4],[1363150800000,18.45],[1363237200000,18.4],[1363323600000,18.233],[1363582800000,17.51],[1363669200000,17.7],[1363755600000,17.76],[1363842000000,18.05],[1363928400000,17.56],[1364187600000,17.5],[1364274000000,17.6],[1364360400000,18],[1364446800000,18.25],[1364792400000,17.75],[1364878800000,17.86],[1364965200000,17.76],[1365051600000,17.83],[1365138000000,17.542],[1365397200000,17.44],[1365483600000,17.71],[1365570000000,17.71],[1365656400000,17.66],[1365742800000,17.41],[1366002000000,16.68],[1366088400000,17.2],[1366174800000,17.625],[1366261200000,17.635],[1366347600000,18.095],[1366606800000,17.75],[1366693200000,17.97],[1366779600000,17.871],[1366866000000,18.3],[1366952400000,18.75],[1367211600000,19.0! 2],[1367298000000,19.19],[1367384400000,19.9],[1367470800000,19.32],[1367557200000,18.89],[1367816400000,18.8],[1367902800000,19.35],[1367989200000,19.4],[1368075600000,19.44],[1368162000000,19.34],[1368421200000,18.9],[1368507600000,19.3],[1368594000000,19],[1368680400000,18.6],[1368766800000,19.5],[1369026000000,19.228],[1369112400000,19.2],[1369198800000,19.14],[1369285200000,19.05],[1369371600000,18.55],[1369717200000,18.62],[1369803600000,18.48],[1369890000000,18.282],[1369976400000,17.51],[1370235600000,17.84],[1370322000000,17.45],[1370408400000,17.31],[1370494800000,17.43],[1370581200000,16.52],[1370840400000,16.2],[1370926800000,15.15],[1371013200000,15.13],[1371099600000,15.35],[1371186000000,15.5],[1371445200000,15.9],[1371531600000,16.64],[1371618000000,15.76],[1371704400000,14.31],[1371790800000,14.5],[1372050000000,14.43],[1372136400000,13.95],[1372222800000,15],[1372309200000,14.93],[1372395600000,15.38],[1372654800000,15.75],[1372741200000,15.7],[1372827600000,15.11],[1373000400000,15.05],[1373259600000,14.85],[1373346000000,14.45],[1373432400000,14.19],[1373518800000,15.49],[1373605200000,15.78],[1373864400000,15.61],[1373950800000,15.7],[1374037200000,15.95],[1374123600000,16.28],[1374210000000,15.99],[1374469200000,15.7],[1374555600000,16],[1374642000000,15.45],[1374728400000,15.599],[1374814800000,15.543],[1375074000000,15.29],[1375160400000,15.98],[1375246800000,15.83],[1375333200000,15.9],[1375419600000,16.093],[1375678800000,15.8],[1375765200000,15.7],[1375851600000,15.71],[1375938000000,15.6],[1376024400000,16.

Famous bull: Market has room to run

Famous bull: Market has room to run